US stocks rose on Thursday as Big Tech gains offset concerns over trade tensions and the ongoing government shutdown.

The S&P 500 climbed 0.3%, the Nasdaq Composite advanced 0.5%, and the Dow Jones Industrial Average gained 110 points, or 0.3%.

Tech stocks led the rally.

Nvidia shares rose 1.2%, while Broadcom jumped 2% after Taiwan Semiconductor, which supplies chips for Nvidia, raised its 2025 revenue guidance to mid-30% growth from roughly 30% and reaffirmed plans to invest up to $42 billion in capital expenditures this year.

Taiwan Semiconductor also reported a nearly 40% surge in third-quarter profit.

Salesforce surged 6%, the best-performing Dow member in early trading, after raising long-term revenue targets to more than $60 billion by 2030. Micron added 3.5% following a bullish call from UBS.

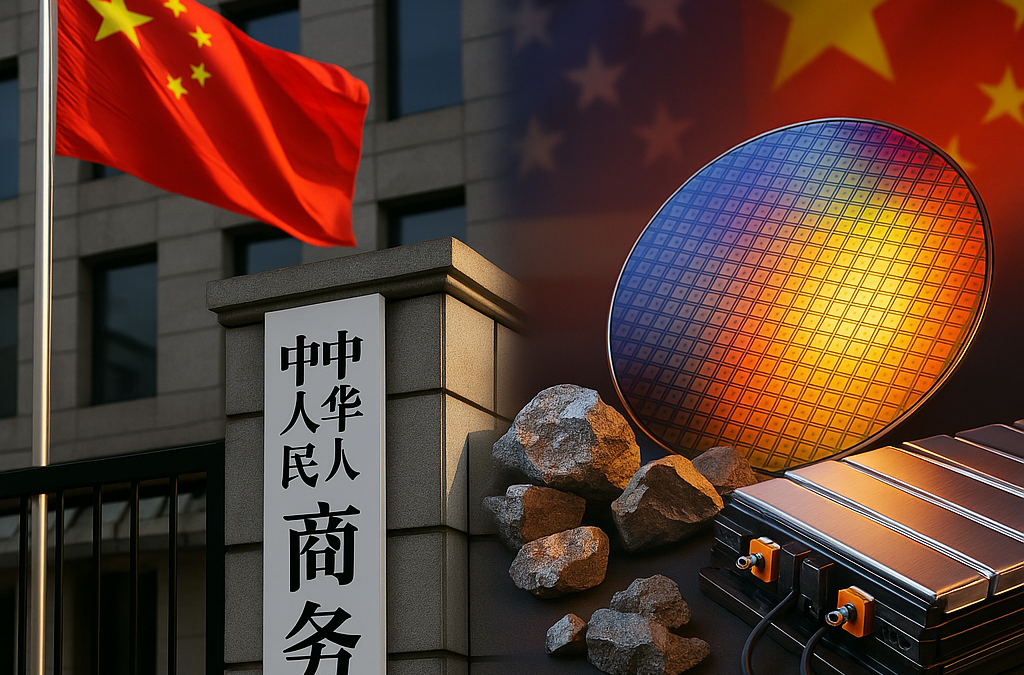

Investors remain cautious despite the gains. The Cboe Volatility Index hovered around 20, reflecting elevated market jitters amid renewed US-China trade tensions.

Last week, President Donald Trump threatened an additional 100% tariff on Chinese imports over export controls on rare earth minerals, and on Tuesday escalated threats with a potential cooking oil trade ban.

The third week of the US government shutdown has also stalled key economic data releases, leaving traders with limited information as concerns over the labour market, tariffs, high interest rates, and historically elevated valuations persist.

Where will the Fed go?

Federal Reserve officials remain split over the pace of upcoming rate cuts, balancing support for a slowing labour market against persistent inflation risks.

Governor Christopher Waller said Thursday that the Fed can continue trimming rates in cautious 25-basis-point increments to avoid policy missteps.

“You don’t want to make a mistake, so the way to avoid that is to go cautiously or carefully and do 25, wait and see what happens, and then you can get a better idea of what to do,” he told Bloomberg Television.

Fed Chair Jerome Powell signalled earlier this week that the central bank is on track for a quarter-point reduction at the end of October, the second cut of the year amid slowing job growth.

Inflation, however, remains above the Fed’s 2% target, prompting officials to remain vigilant.

Stephen Miran, meanwhile, argued for a larger half-point cut, citing renewed US-China trade tensions as a downside risk to growth.

Speaking on Fox Business, Miran, a temporary Fed governor and former chair of the White House Council of Economic Advisers, said a more restrictive policy in the face of such shocks “does materially increase the negative consequences.”

He acknowledged that the Fed will likely reduce rates by 25 basis points, as in September, but suggested three such cuts could occur this year.

The post US stocks in the green at open: Dow climbs over 100 points, Nasdaq up 0.5% appeared first on Invezz